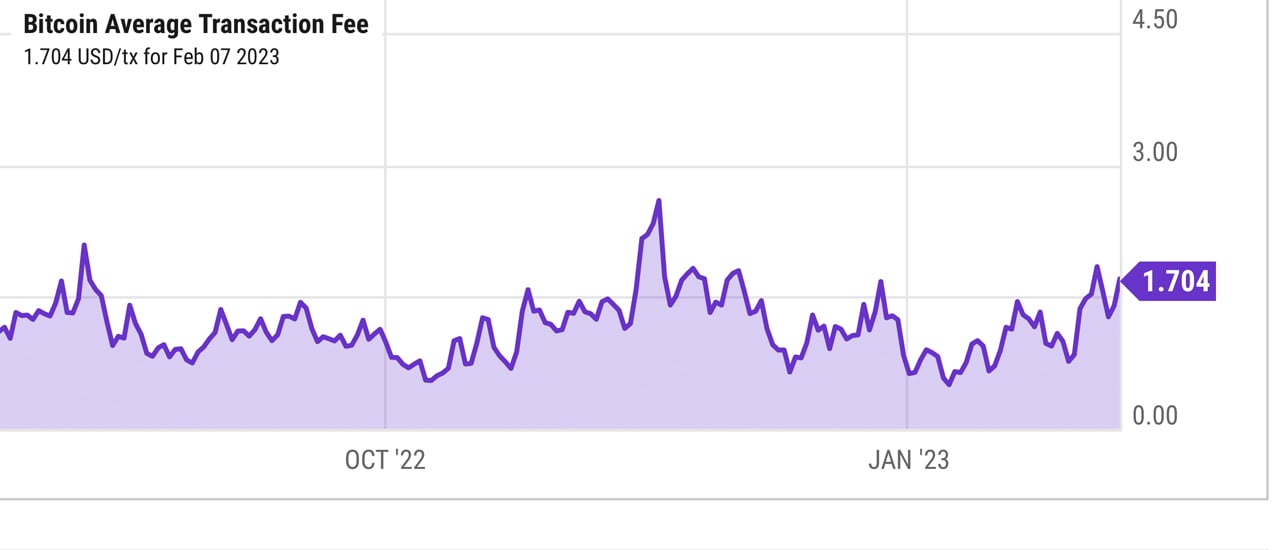

Statistics show transfer fees on the Bitcoin network have increased 122% since the end of last month, as the average transaction fee has climbed from $0.767 to $1.704 per transaction. The rise in onchain fees coincides with the new Ordinals digital collectible trend on the network, with the number of inscriptions nearing 20,000.

Rising Transaction Fees Help Bitcoin Miners Reap Increased Revenue Despite Falling Spot Prices

Bitcoin network fees, or the average cost to transfer BTC, rose 122% during the first week of Feb. 2023. Statistics from bitinfocharts.com and ycharts.com show the average transaction on Feb. 7, 2023, was around 0.000075 BTC or $1.70 per transfer. Onchain fees on Jan. 29, ten days prior, were roughly $0.767, according to the statistics. Users generally pay lower fees than the average, and the median-sized onchain transfer using the Bitcoin network at that time was around $0.167 per transfer. As of Feb. 7, median-sized fees have increased 316% to $0.696 per transfer.

The number of unconfirmed transactions in the mempool has been between 7,500 and 25,000 over the past 24 hours. While average and median-sized onchain fees have risen to values between $0.69 and $1.70 per transfer, some users are paying around four satoshis per byte, or approximately $0.13 using current BTC exchange rates. The rise in fees coincides with the demand for Ordinals, which has pushed onchain inscriptions to 18,731 as of 1:15 p.m. Eastern Time. Bitcoin (BTC) miners are also seeing increased revenue from the fees.

On January 29, bitcoin miners earned 0.83 BTC from fees alone, and ten days later, on February 7, daily fees earned by miners equated to 2.442 BTC. This means that instead of just over $19,000 in fees, bitcoin miners earned over $56,000 from fees on Tuesday. This is helpful for miners as BTC spot prices have been lower in the last 24 hours, and the cost of producing BTC has been higher. Statistics for Feb. 7 indicate the cost of producing BTC, according to macromicro.me charts, is around $24,260, while BTC’s spot value on Wednesday is just under $23,000.

What impact will the rise in Bitcoin network fees have on the future of the network? Share your thoughts in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer